Part I.1 – Prompt Payment

Overview: This Part sets out short timelines for the payment of contractor and subcontractor invoices. The payer is required to make payments in accordance with the timelines, unless it provides a notice of non-payment. Amounts not paid in accordance with the timelines will accrue interest at a specified rate. The prompt payment regime applies to both private and public contracts.

A – Payment Trigger

The trigger for payment is the delivery of a proper invoice to the owner. It is provided on a monthly basis, unless the contract provides otherwise. A contract cannot make the giving of a proper invoice contingent upon payment certification or the prior approval of the invoice by the owner.

B – Proper Invoice

Proper invoice must contain the following information:

a) The contractor’s name and address;

b) The date of the proper invoice and the period during which services or materials were supplied;

c) Information identifying the authority (typically the contract) under which services or materials were supplied;

d) Description, including quantity, of the services or materials that were supplied;

e) The amount payable for services or materials that were supplied and payment terms;

f) The name, title, telephone number, and mailing address of the person to whom payment is to be sent; and

g) Any other information that may be prescribed by the contract.

C – Payment Period

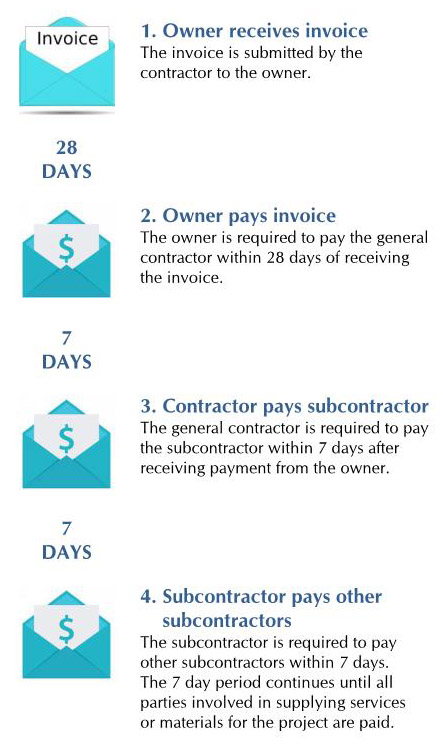

Upon submission of a proper invoice, the owner shall pay the amount payable within 28 days (unless the owner delivers a notice of non-payment, see below).

A contractor who receives full payment of a proper invoice within the 28 days must, no later than 7 days after receiving payment, pay each subcontractor who supplied services or materials included in the proper invoice.

A contractor who receives partial payment of a proper invoice must, no later than 7 days after receiving payment, pay each subcontractor, who supplied services or materials included in the proper invoice, the amount earmarked for that subcontractor or, where no amount is specifically identified, pay the subcontractors on a pro rata basis.

D – Payment Withheld

An owner who disputes a proper invoice can refuse to pay all or any portion of the proper invoice IF, no later than 14 days after receiving the proper invoice, the owner gives the contractor a notice of non-payment (in the prescribed form and manner) specifying the amount that is not being paid and detailing all of the reasons for non-payment. If only a portion of the invoice is disputed, the owner must still pay the undisputed amount within the 28 days.

As with an owner, a contractor can dispute a subcontractor’s entitlement to payment, in whole or in part, within the time specified IF the contractor gives notice of non-payment to the subcontractor no later than 7 days after receipt of a notice of non-payment from the owner or, if no notice is given by the owner, no later than 35 days after the proper invoice was given to the owner. The notice of non-payment again shall be made in the prescribed form and manner, detailing the amount that is not being paid and the reasons for non-payment. The same applies to payments from subcontractors to subcontractors.

E – Remedies in Event of Non-Payment

If the owner does not pay some or the entire invoice to the contractor, the contractor has two options:

1 – To pay the subcontractor no later than 35 days after giving the proper invoice to the owner; OR

2 – To give notice of non-payment to the subcontractor no later than 7 days after receiving notice of non-payment from owner or, if no notice is given by the owner, before the expiry of the 35 days from delivery of the proper invoice to the owner.

If an amount is not paid when it is due under this Part, interest shall be paid on the outstanding balance at the prejudgment interest rate determined under section 127(2) of the Courts of Justice Act or, if the contract/subcontract specifies a different interest rate for the purpose, the greater of the two.

Catherine E. Willson is Counsel in the law firm, Goldman Sloan Nash & Haber LLP, (willson@gsnh.com) a full service law firm in Toronto, Ontario (www.gsnh.com). This information deals with complex matters and may not apply to particular facts and circumstances. The information reflects laws and practices that are subject to change. For these reasons, this information should not be relied on as a substitute for specialized professional advice in connection with any particular matter.